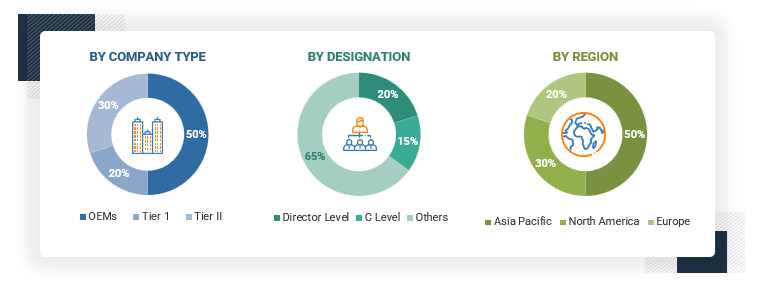

This research study involved the extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the Electric Commercial Vehicle market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players (ECVs manufacturers and suppliers), and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the electric commercial vehicle market for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

Extensive primary research was conducted after understanding the electric commercial vehicle market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (electric commercial vehicle manufacturers and component manufacturers) sides across major regions, namely, North America, Europe, and Asia Pacific. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the opinions of in-house subject matter experts, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

-

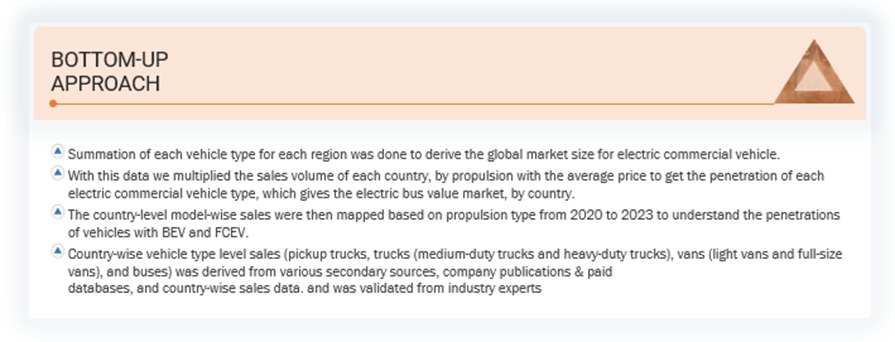

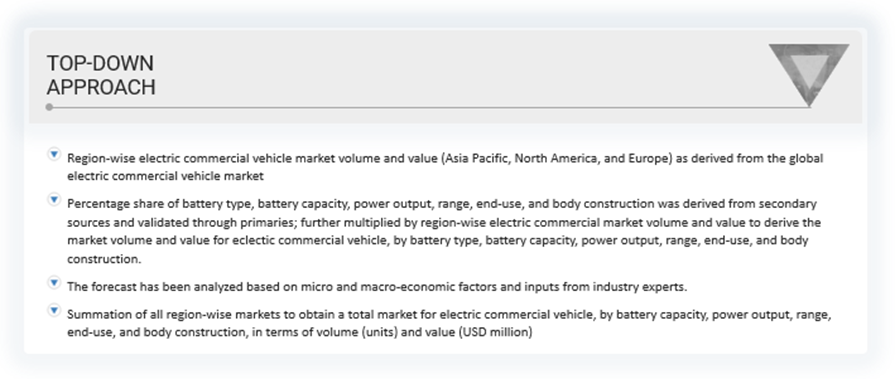

A detailed market estimation approach was followed to estimate and validate the value and volume of the electric commercial vehicle market and other dependent submarkets, as mentioned below:

-

The market size was derived by collecting sales of electric commercial vehicles (Pickup Trucks, Medium-duty and Heavy-duty Trucks, Light and Full-Size Vans, and Buses & Coaches) through association and paid databases.

-

Key players in the electric commercial vehicle market were identified through secondary research, and their global market share was determined through primary and secondary research.

-

The research methodology includes the study of annual and quarterly financial reports, regulatory filings of major market players, and interviews with industry experts to gain detailed market insights.

-

All major penetration rates, percentage shares, splits, and breakdowns for the electric commercial vehicles market were determined through secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

According to the European Alternative Fuels Observatory (EAFO), an electric vehicle is any motor vehicle that can be recharged from an external source of electricity. The electricity stored in the rechargeable battery packs drives the wheels. Electric commercial vehicles include pickup trucks, trucks, buses, and vans that use electric motors for propulsion. These vehicles are powered by electricity and used for commercial purposes, like transporting goods or passengers.

List of Key Stakeholders

-

Associations, Forums, and Alliances related to Electric Trucks

-

Automobile Manufacturers

-

Automotive Component Manufacturers

-

Automotive Investors

-

Automotive Software Manufacturers and Providers

-

Battery Distributors

-

Battery Manufacturers

-

Charging Infrastructure Providers

-

Charging Service Providers

-

Companies Operating in Autonomous Vehicle Ecosystem

-

Distributors and Retailers

-

Electric Pickup Truck Manufacturers

-

Electric Van Manufacturers

-

Electric Medium and Heavy-duty Truck Manufacturers

-

EV Battery Manufacturers

-

EV Charging Equipment Manufacturers

-

EV Charging Infrastructure Service Providers

-

EV Component Manufacturers

-

EV Distributors and Retailers

-

Government Agencies and Policy Makers

-

Original Equipment Manufacturers

-

Raw Material Suppliers for Automotive Software or Components

-

Technology Providers

-

Transport Authorities

-

Technology Providers

-

Vehicle Electronics Manufacturers

Report Objectives

-

To segment and forecast the size of the electric commercial vehicle market in terms of volume (units) and value (USD million) from 2019 to 2030

-

To define, describe, and forecast the electric commercial vehicle market based on body construction, vehicle type, propulsion, battery type, battery capacity, power output, range, end use, component, and region

-

To segment and forecast the market size by volume based on body construction (integrated, semi-integrated, and full-sized)

-

To segment and forecast the market size by volume and value at the regional level based on vehicle type [pickup trucks, trucks (medium-duty trucks and heavy-duty trucks), vans (light vans and full-size vans), and buses & coaches]

-

To segment and forecast the market size by volume based on propulsion (BEVs and FCEVs)

-

To segment and forecast the market size by volume based on battery type (NMC batteries, LFP batteries, solid-state batteries, and others)

-

To segment and forecast the market size by volume based on battery capacity (less than 60 kWh, 60–120 kWh, 121–200 kWh, 201–300 kWh, 301–500 kWh, and 501–1,000 kWh)

-

To segment and forecast the market size by volume based on power output (less than 100 kW, 100–250 kW, and above 250 kW)

-

To segment and forecast the market size by volume based on range (less than 150 miles, 151–300 miles, and above 300 miles)

-

To segment and forecast the market size by volume based on end use (last-mile delivery, field services, distribution services, long-haul transportation, and refuse trucks)

-

To segment the market based on component (battery packs, onboard chargers, electric motors, inverters, DC-DC converters, e-axles (including gearboxes), and fuel-cell stacks)

-

To forecast the market size with respect to key regions, namely, Asia Pacific, Europe, and North America

-

To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile key players and comprehensively analyze their market share and core competencies

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To track and analyze competitive developments such as product launches, deals, and others undertaken by the key industry participants

-

To study the following with respect to the market:

-

Supply Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

Trade Analysis

-

Case Study Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Conferences and Events

-

Average Selling Price Analysis

-

Buying Criteria

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To track and analyze competitive developments such as product developments, deals, and others undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

-

Electric Commercial Vehicle Market, by End Use, at regional level (for countries covered in the scope of the report)

-

Electric Commercial Vehicle Market, by Body Construction at regional level (for countries covered in the scope of the report)

-

Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Electric Commercial Vehicle Market